Measure gives policyholders more options as FEMA prepares for implementation of new NFIP premium rate structure this week.

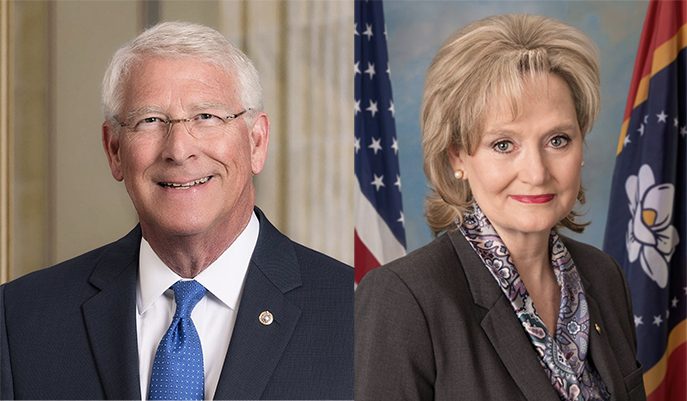

On Monday, U.S. Senator Cindy Hyde-Smith (R-MS) introduced the Homeowner Flood Insurance Transparency and Protection Act. The legislation allows policyholders to retain existing premium rates as the Federal Emergency Management Agency (FEMA) prepares for nationwide implementation of its new National Flood Insurance Program (NFIP) rate structure.

FEMA is on course to fully implement Risk Rating 2.0 nationwide on Friday, April 1.

Senator Hyde-Smith said that policy holders deserve to know how much they are going to be paying over the full course of this program and why, especially during a time of record inflation and gas prices.

“FEMA is charging full force to impose Risk Rating 2.0 no matter the consequences. This legislation would protect homeowners and the overall health of the NFIP while FEMA responds to outstanding bipartisan concerns and questions about the methodology and rollout of this program,” Hyde-Smith stated.

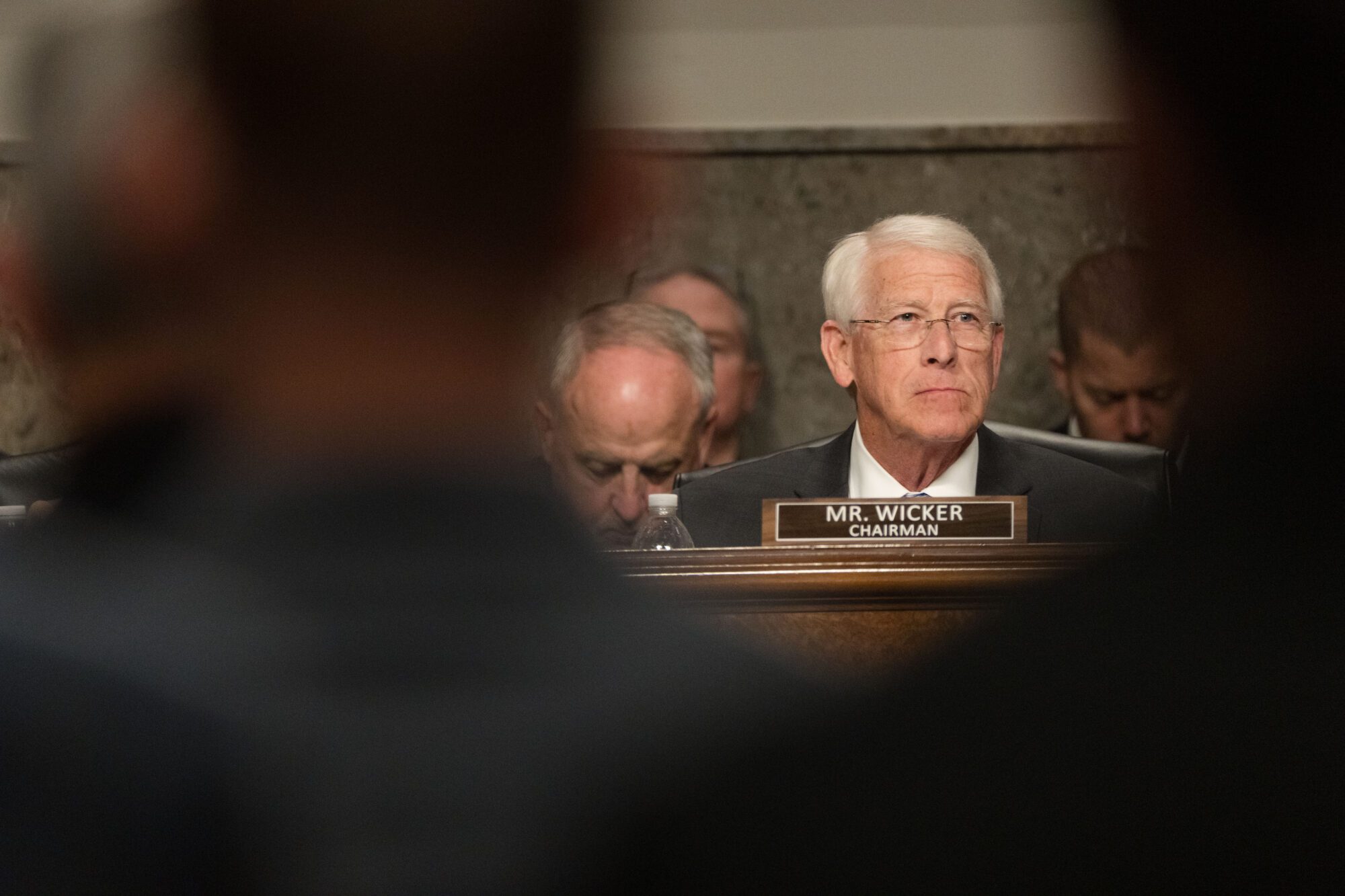

U.S. Senator Roger Wicker (R-MS) is an original co-sponsor of the legislation. Wicker said that he is proud to join Hyde-Smith and their Senate colleagues to introduce this bill which would provide the transparency our state needs to see from FEMA.

“Many Mississippi communities are at risk of flooding and rely on the National Flood Insurance Program as a lifeline. I have heard from residents across the state that they are concerned about rising flood insurance premium rates under FEMA’s new Risk Rating 2.0 system. Mississippians should not be penalized with high insurance rates calculated under FEMA’s bureaucratic process,” Senator Wicker said.

You can view a full copy of the legislation below. Click here for a bill summary.

Homeowner Flood Insurance Transparency and Protection Act by yallpolitics on Scribd