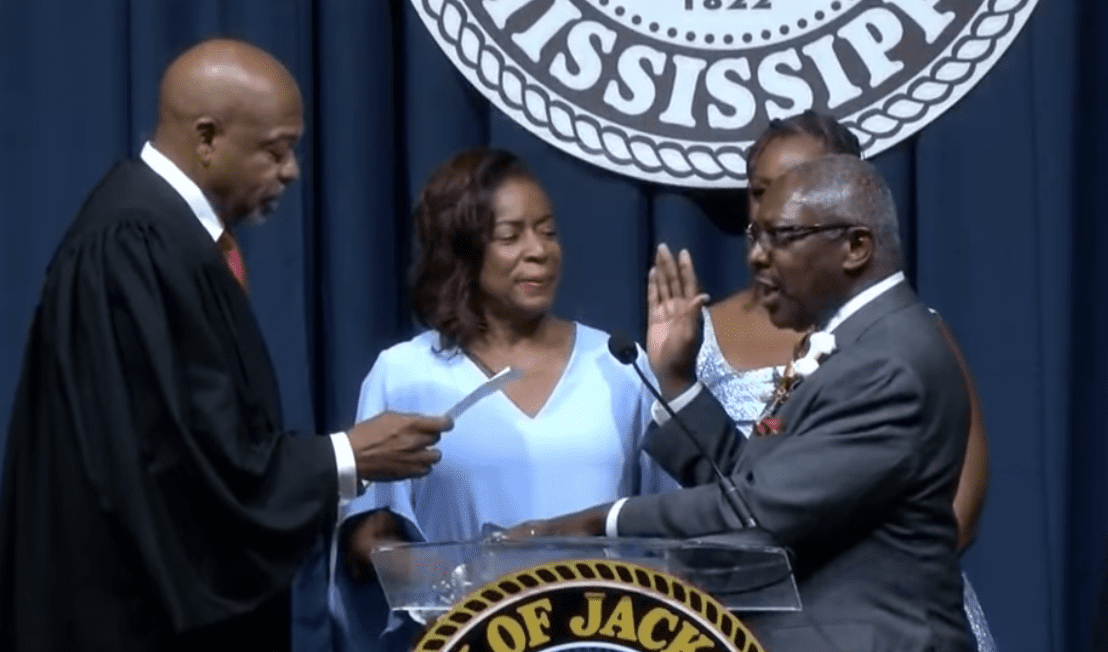

Treasurer David McRae

Mississippi Treasurer David McRae joined 22 other state Treasurers, Auditors and financial officers to oppose the current proposal from the Biden administration that would allow the IRS to monitor American’s individual bank accounts when a transaction of more than $600 in deposited funds happens.

McRae remarked in his press release that if the proposal is enacted, the private banking activity of more than 100 million Americans could be subject to examination by the IRS. It is believed that the goal of allowing this invasion of privacy is to target individuals not paying their full income tax, in hopes to generate a large sum of money to cover the $3.5 trillion spending proposal being pushed by the administration.

“We do not believe the federal government should give the IRS the unprecedented and unconstitutional power to peer into law-abiding citizens’ private financial accounts,” wrote McRae and the financial officers in a letter to President Biden and Treasury Secretary Yellen. “This would be one of the largest infringements of data privacy in our nation’s history and is a direct assault on the financial disclosures of all Americans.”

The proposed IRS monitoring plan was first made in May 2021 and is being included in conversations around the $3.5 trillion spending bill currently being debated in the U.S. Congress. While there is no clear cut legislation proposed at this point, lawmakers in the U.S. House and Senate who oppose the proposal worry it could be presented by Democratic leadership at any time.

“If passed, this will be one of the largest and most continuous data mining exercises against Americans in our history and will put a constant strain on customer privacy, data security, and overall safety of the banking system,” the financial officers’ letter continued. “Moreover, there are no guardrails in place to prevent any abuse of this information by the IRS or other government actors. We urge you to consider the negative impacts this initiative would have.”

About the Author(s)

Sarah Ulmer

Sarah is a Mississippi native, born and raised in Madison. She is a graduate of Mississippi State University, where she studied Communications, with an emphasis in Broadcasting and Journalism. Sarah’s experience spans multiple mediums, including extensive videography with both at home and overseas, broadcasting daily news, and hosting a live radio show. In 2017, Sarah became a member of the Capitol Press Corp in Mississippi and has faithfully covered the decisions being made by leaders on some of the most important issues facing our state. Email Sarah: sarah@magnoliatribune.com

More Like This

Previous Story

Next Story