Soaring gas prices make talks of state gas tax increase to fix infrastructure DOA.

Economists generally believe that artificially high gas prices are one of the most pernicious economic penalties that disproportionately affects lower income earners, a segment of the population Democrats say their policies are meant to help. But gas prices in Mississippi are up over $1.20 per gallon since President Joe Biden won the 2020 election, and while Mississippi generally ranks near the bottom in terms of gas prices nationally, the Magnolia State ranks 8th nationally in terms of gas consumption per capita generally because of low population density as a rural state.

How Did We Get Here?

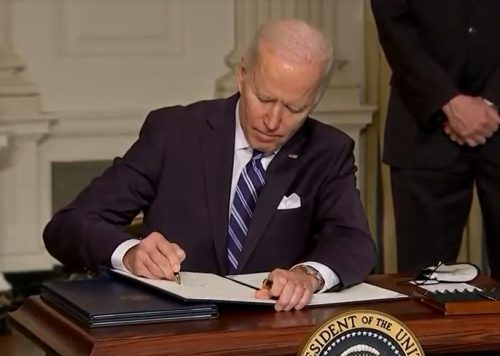

On his first day in office, President Biden threw climate change activists a bone when he canceled the Keystone Pipeline, revoking its cross-border permit resulting in the loss of over 10,000 jobs and the potential for safer transportation of crude oil. He has since issued additional executive orders halting fracking and new oil and gas leases on federal lands as part of a moratorium on oil and gas lease activities.

In recent weeks, Russian hackers shut down the Colonial Pipeline. Yet, the Biden Administration decided to waive sanctions on the Russian-German Nord Stream 2 pipeline just days after the Colonial Pipeline hacking. U.S. Senator Ted Cruz (R-TX) called it a “reward to Russia for Russian hackers shutting down a major infrastructure pipeline on the Eastern Seaboard.” Cruz added that President Biden’s approach of limiting U.S. oil exploration while paving the way for Russia’s energy expansion is “asinine.”

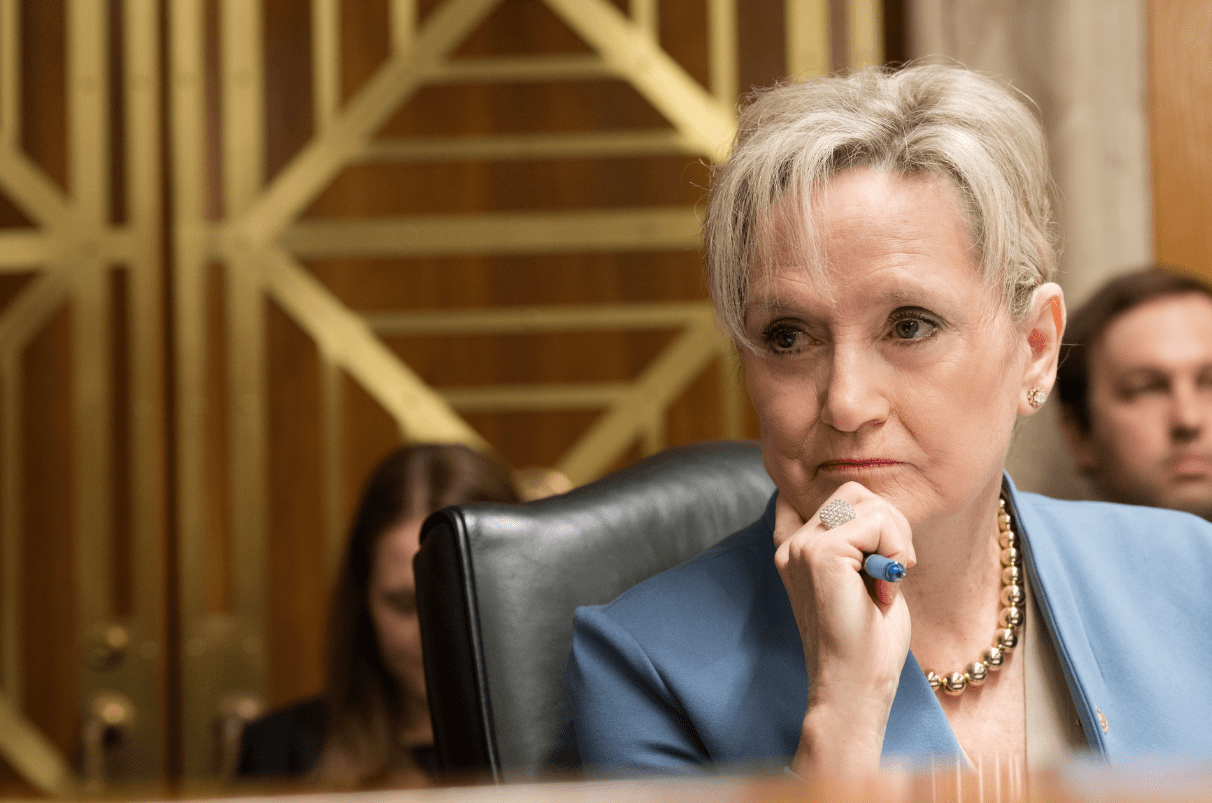

Mississippi U.S. Senator Cindy Hyde-Smith joined 13 of her Senate colleagues in sending a letter to President Biden outlining concerns about his decisions that have weakened American energy independence and emboldened the nation’s adversaries.

“We are writing to you to express our strong opposition against the actions you have taken related to our nation’s energy infrastructure and national security,” the Senators wrote. “In your first 100 days in office, you have cancelled the Keystone XL pipeline, our country has experienced one of the worst gasoline shortages since the 1970s, and you waived the application of congressionally mandated sanctions paving the way for Russia to complete the Nord Stream 2 pipeline.”

This week, President Biden suspended oil and gas leases in Alaska’s Arctic National Wildlife Refuge. The action reversed a drilling program approved by the Trump Administration that, when coupled with other initiatives, was aimed at making the U.S. more energy independent. If nearly record low gas prices were any indication, the policies seemed to be working.

At the beginning of May 2020, the average price for a gallon of gas in Mississippi was near $1.50, according to GasBuddy. From May 2020 to November 2020, the average price for a gallon of gas had hovered around $1.75.

After November 2020, gas prices began a steep increase, rising to around $2.70 per gallon – nearly a dollar increase in 6 months and $1.20 increase in a year. That translates to a $1,044 increase per capita annually, which again affects those on the lower end of the economic spectrum the most.

Mississippi State Representative Charles Busby (R-HD 111) is not a fan of what he is seeing from the President. He is the Chairman of the House Transportation Committee tasked with not only finding ways to literally make the state move but how to pay for the infrastructure that requires.

“By restricting drilling, shutting down pipelines and coming across weak globally which inspires those who would launch cyber attacks against us the left has sent gas prices on an uphill trajectory like we haven’t seen since the great ‘Oil Shortage’ of the ‘70’s,” Busby told Y’all Politics. “They [Biden Administration] are subsidizing inadequate energy sources completely incapable of meeting the needs of this nation and the world.”

Rep. Busby, an engineer by trade, is a small business owner and understands first hand the impact Biden’s policies will have on industries beyond the oil and gas sector.

“Now they want to raise taxes on those who drive America and make her work. They seem unable to acknowledge that it is these exact innovators that will be needed to make these energy sources work,” Busby continued. “Yet, this administration seems intent on removing all incentive to be a pioneer, an innovator, an entrepreneur. Their proposed tax policies would make anyone question whether they really wanted to setup business here. What should you bust your ass only to have them take whatever they want and distribute it for votes? Are they focused on killing the American dream?”

What Biden’s Energy Policies Mean For Mississippi?

More oil restrictions, less leasing and production, higher costs, and less energy for the U.S. as a whole generally correlate to less economic development and lower job growth over time, but it also means less money in the pockets for Mississippians in a rural state where gas consumption is naturally higher.

Oil & Gas 360 reported in August 2020 that according to the latest data estimates in the U.S. Energy Information Administration’s (EIA) State Energy Data System (SEDS), “people in geographically large states with small populations, such as Alaska, Wyoming, and North Dakota, used twice as much energy for transportation than the U.S. average on a per capita basis. States with higher population density, such as Rhode Island and New York, used less transportation energy per capita in 2018.”

Mississippi is among the top 5 states for transportation energy consumption per capita. This includes all energy used by automobiles, trains, aircraft, ships, and other vehicles whose primary purpose is to transport people or goods, or both, from one place to another.

Mississippi remains one of the cheapest states for gas. The U.S. EIA says Mississippi ranks among the 5 states with the lowest average gasoline prices, but among the top 10 states in gasoline expenditures per capita.

The highest gas prices continue to be seen on the West Coast, with California reporting above $4.00 a gallon. As of today, the average gas price per gallon in the Magnolia State is $2.69 compared to $1.60 on the same day one year ago. Meridian has the cheapest gas at $2.44 while Byhalia has the most expensive at $3.09.

However, according to the latest U.S. EIA report on file from 2018, Mississippi ranks 8th in gas expenditures per capita.

Currently, for every gallon of gas sold in Mississippi, the state receives 18.4 cents, regardless of the price of the gallon at the pump. House Democratic Leader State Rep. Robert Johnson told Y’all Politics that it has been that way since 1993 and it is just not enough to maintain the state’s roads and bridges.

“We have poor roads in Mississippi and unsafe or closed bridges. You can’t fix or maintain roads without money,” Johnson said. “The tax of 18.4 cents a gallon has not been raised since 1993. The construction cost of maintaining a highway has grown more than 5 times that in the same amount of time.”

In fact, the 18.4 cent gas tax has been in place since 1987, not 1993. But in 2018, the Mississippi legislature did authorize the state lottery that is generating an additional $80,000,000 into road and bridge funding.

House Transportation Chairman Rep. Busby agreed with his colleague across the aisle in theory.

“First, it’s necessary to establish that building and maintaining our roads and bridges is a core function of government. If the government doesn’t have this responsibility then who does? It is conservative to require that those who utilize an asset should be the ones who pay for that asset,” Busby said. “Right now the primary source of funds for these core functions of government is the gas tax which has not been adjusted in Mississippi since 1987.”

Rep. Johnson added that poor roads and closed bridges cost Mississippian’s close to $500 per year in automobile maintenance and extra gas bought specifically to drive alternative routes because of closed roads and bridges.

“If we were to increase the gas tax somewhere around 15 cent a gallon we could repair bridges and fix roads resulting in a net gain for Mississippi drivers as well as provide jobs and help 3 to 5 generation home grown small businesses, thereby helping our economy,” Johnson said. “We can’t have real economic development without investing in and improving our infrastructure.”

That 15 cents Rep. Johnson proposes would mean the average Mississippian would pay close to $130 more each year in taxes. Couple that with the already high price per gallon now pushing an additional $1,000 annually and the result could increasingly affect the pocketbooks of less fortunate Mississippians. However, there has generally been little appetite in the Legislature or with Governor Tate Reeves for a straight gas tax hike of any sort.

But this is the conundrum the Biden Administration has created. It puts states with infrastructure repair needs in a predicament when trying to balance policy debates on life and safety issues with practical, pocketbook concerns around the family kitchen table.

Asking Mississippians to pay more in taxes when they already feel gouged at the pump means those state policy considerations are dead on arrival as such actions would surely cost many Republicans and some Democrats their seats at the Capitol, even if there are obvious repair needs.

President Biden’s efforts to discourage fossil fuel usage to appease his most left-leaning members in the Democratic Party seem to have resulted in a “soft tax” on all consumers. Resulting high gas prices, at least in the near term, have wiped out any hope of a targeted gas tax increase to repair Mississippi’s infrastructure because the real and political costs would be just too great.