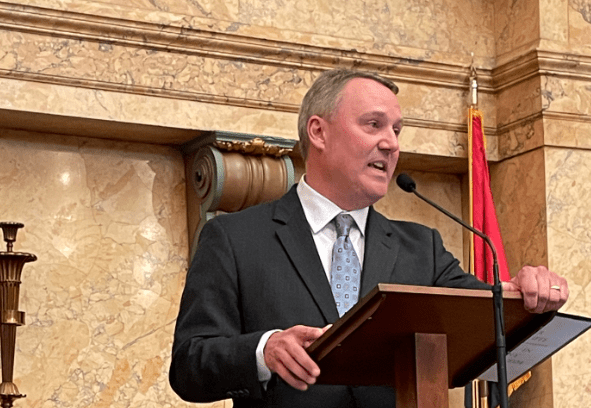

Treasurer David McRae

By: Treasurer David McRae

More than one in three Mississippi adults live with some kind of disability, well above the national average of 25 percent. For many of these families, the disabilities come with added expenses, such as higher health care, housing, and transportation costs.

In fact, Mississippians spend $4.5 billion annually on disability-related health care expenses alone, according to the Centers for Disease Control and Prevention. As a result, many with disabilities rely on social safety net programs to help cover those health care expenses, as well as basic costs like food and housing.

But prior to 2014, the receipt of such assistance meant beneficiaries were limited when it came to putting money away in savings. The limits were strict. Just $2,000 in savings could disqualify someone from receiving necessary support.

In the end, many with disabilities were forced to remain in poverty just to receive the public benefits they required. In December 2014, however, things changed. Congress passed the ABLE Act, giving thousands of Mississippi families a path to greater financial stability.

Today, those with disabilities and their families can set up an ABLE account, which allows them to save money without jeopardizing necessary benefits. These are tax-advantaged accounts that can be used to pay for disability-related expenses, including education, housing, transportation, employment training and support, assistive technology, personal support services, health care expenses, financial management, administrative services, and more.

To be eligible for an ABLE account, the disability’s onset must have occurred before the beneficiary turned 26 years old. If you or your loved one meet that criteria and receive SSI or SSDI benefits, you are automatically eligible to open an ABLE account. Even if you don’t meet those criteria, you might still be eligible, but additional paperwork will be necessary before enrolling.

Once you’ve opened an ABLE account, the beneficiary, as well as their family and friends, can contribute to it. Then, families or the beneficiaries themselves get to choose how the money is invested, giving you the opportunity to grow your savings over time.

If you believe an ABLE account would benefit you or a family member, please visit Treasury.MS.gov/ABLE to learn more or call my office at (601) 359-3600. We are ready to help more Mississippians become ABLE to save.

Press Release

3/19/2021

About the Author(s)

Magnolia Tribune

This article was produced by Magnolia Tribune staff.

More Like This

More From This Author

Previous Story

Next Story