Congressman Michael Guest (MS-03) voted against H.Con.Res. 11, the shell of a budget proposal required for advancing Democratic plans to invoke budget reconciliation, a process that would avoid the 60-vote threshold ordinarily required to approve legislation in the United States Senate. This is the first step to pass President Biden’s $1.9 trillion COVID-19 relief plan that is likely to include mandating a $15 minimum wage, a proposal Congressman Guest opposes, citing the 1.3 million jobs the minimum wage law would destroy. The Democrats’ COVID-19 relief has received pushback from House and Senate Republicans, citing the size of the relief bill, the partisan provisions and nature of the process, and the speed at which President Biden departed from his message promoting “unity.”

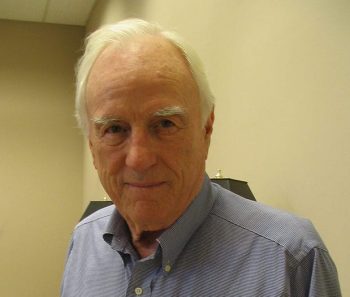

“The economy is on the mend, and we have seen projections for strong economic growth over the next 10 years. This would not have been achievable without the economic relief the Trump Administration and Congress worked together in a bipartisan effort to achieve,” Congressman Guest said. “Unfortunately, President Biden, backed by the Progressive wing of his party, is using COVID relief in an attempt to claim responsibility for the economic and public health wins that the bipartisan efforts under the Trump Administration brought our nation. Sadly, it has become clear that Democrats had no interest in continuing these bipartisan efforts when they opted to use the budget reconciliation process in an attempt to approve partisan legislation.”

The Congressional Budget Office released a study earlier this week that projects “real GDP [will expand] rapidly over the coming year, reaching its previous peak in mid-2021.” The CBO attributes its new and positive outlook to a less severe economic downturn than it originally projected and to a recovery that was stronger and quicker than projected. While many factors contribute to the recovery of the economy, the CBO mentions the positive impact of the Consolidated Appropriations Act of 2021 passed in December and negotiated by the Trump Administration and leaders from both parties in Congress to fund coronavirus relief efforts.

“It’s evident from the economic data that the bipartisan measures we passed in 2020 were adequate to support our coronavirus relief efforts. The economic data just doesn’t justify another COVID relief package, especially not one with an almost $2 trillion price tag,” Congressman Guest said.

Other economic factors back up the claims that a $1.9 trillion coronavirus package is unnecessary. In the Bloomberg article, “The U.S. Economy’s Improving—and That Could Complicate Biden’s Stimulus Plan,” the improving economy is highlighted. As the savings rate, unemployment rate, unemployment claims, payroll data, consumer confidence, consumer spending, GDP growth, and more economic factors continue to point to the success of previous stimulus bills, questions will remain about the necessity of additional stimulus legislation.

With approximately a quarter of all Congressional COVID relief funds remaining unspent, Congressman Guest questioned the need for more funding. “I think it is crucial that we utilize the $1 trillion in unspent COVID relief funds and assess the economic need before we pursue more stimulus. The President should focus on real solutions, like increasing the rate of vaccinations above the baseline level President Trump was able to set, instead of pushing through a partisan budget proposal.”

A few of the programs included in the remaining $1 trillion of COVID relief are:

- SBA’s Paycheck Protection Program: $280 billion

- Health Spending: $239 billion

- Economic Injury Disaster Loans: $172 billion

- Unemployment Insurance Expansion: $172 billion

- Education Funding: $59 billion

- State and Local Aid: $58 billion

- Stimulus Checks: $52 billion

- Food Stamps: $33 billion

- Child Care and Development Block Grant: $10 billion

- Agriculture: $29 billion

Press Release

2/4/2021