Mississippi municipalities and counties are essentially forced annually to accept and levy the millage requests that come from their school districts, even if the requested levy includes a tax increase the city council or board of supervisors do not support.

By law, very little information is required to be shared between the school district and their taxing authority, leaving those elected officials and the public in the dark to blindly approve what the school district submits.

Local elected officials in cities and counties have often voiced displeasure with the process, saying they are mandated to approve millage rates where they have no real say as school districts are separate legal entities but remain under the taxing authority of the city or county.

Citizens have called the practice “taxation without representation” as not all school boards are elected; some seats remain appointed by city councils whose hands are tied by state statute to rubberstamp what school districts submit.

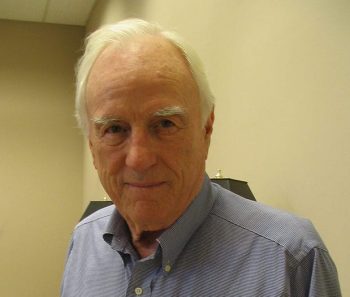

State Rep. Charles Busby (R) is seeking to bring some light to school district tax requests with HB 989, providing a way for the local officials and the public to be better informed of the financial condition within their school district.

“HB 989 is simply transparency,” Busby told Y’all Politics. “It provides the local taxing authority with budget calculations and actual expenditure numbers to ensure that schools are properly funded and that informed decisions can be made for the community.”

The bill would require the Mississippi Department of Education to develop an annual reporting process for school districts to submit financial records that show where school districts receive all monies, whether it be from local ad valorem, state or federal funding, bonds, grants or donations. The reports would be made available to the Legislature, local taxing authorities and the public.

There have been cases in Mississippi where city councils have tried to rein in school district tax increases by denying them or challenging the necessity of the millage increase, but those efforts have ultimately failed in court.

HB 989 would allow municipalities and counties to vet tax levy requests from school districts operating with a budget in excess of 100% of the state funding formula instead of blindly accepting and approving potential tax increases.

That provision is reportedly being removed through an amendment in the House after lobbyists opposed it with House Education leaders.

The original bill stated, “The local governing authority of any school district operating with a budget greater than one hundred percent (100%) of the state funding formula, shall not grant an automatic increase in tax levy to satisfy a school district’s budget requests, if the millage rate necessary to generate funds equal to the dollar amount requested by the school board is equal to fifty-five (55) mills or less, but the dollar amount requested by the school board does not exceed the next preceding fiscal year’s ad valorem tax effort in dollars by more than four percent (4%).”

The Parents Campaign actively lobbied against the language allowing local taxing authorities to have a say in their school district’s millage requests, saying on its website that HB 989 “prohibits local school boards from raising ad valorem taxes for the support of the school district when the district’s state, local, federal, and other funds exceed the minimum in state and local funds called for in the MAEP formula.”

It is the only bill listed on their Bill Tracker they were opposing.

HB 989 is scheduled to be taken up on the floor Thursday afternoon, with the amendment to remove the above provision from the bill while still providing for school districts to report annual financial data.