RELEASE

COCHRAN VOTES FOR TAX REFORM, OPTIMISTIC OF BENEFITS FOR MISSISSIPPI & NATION

Says Mississippians Will Keep More of Their Earnings, Businesses Get Tax Incentives to Grow

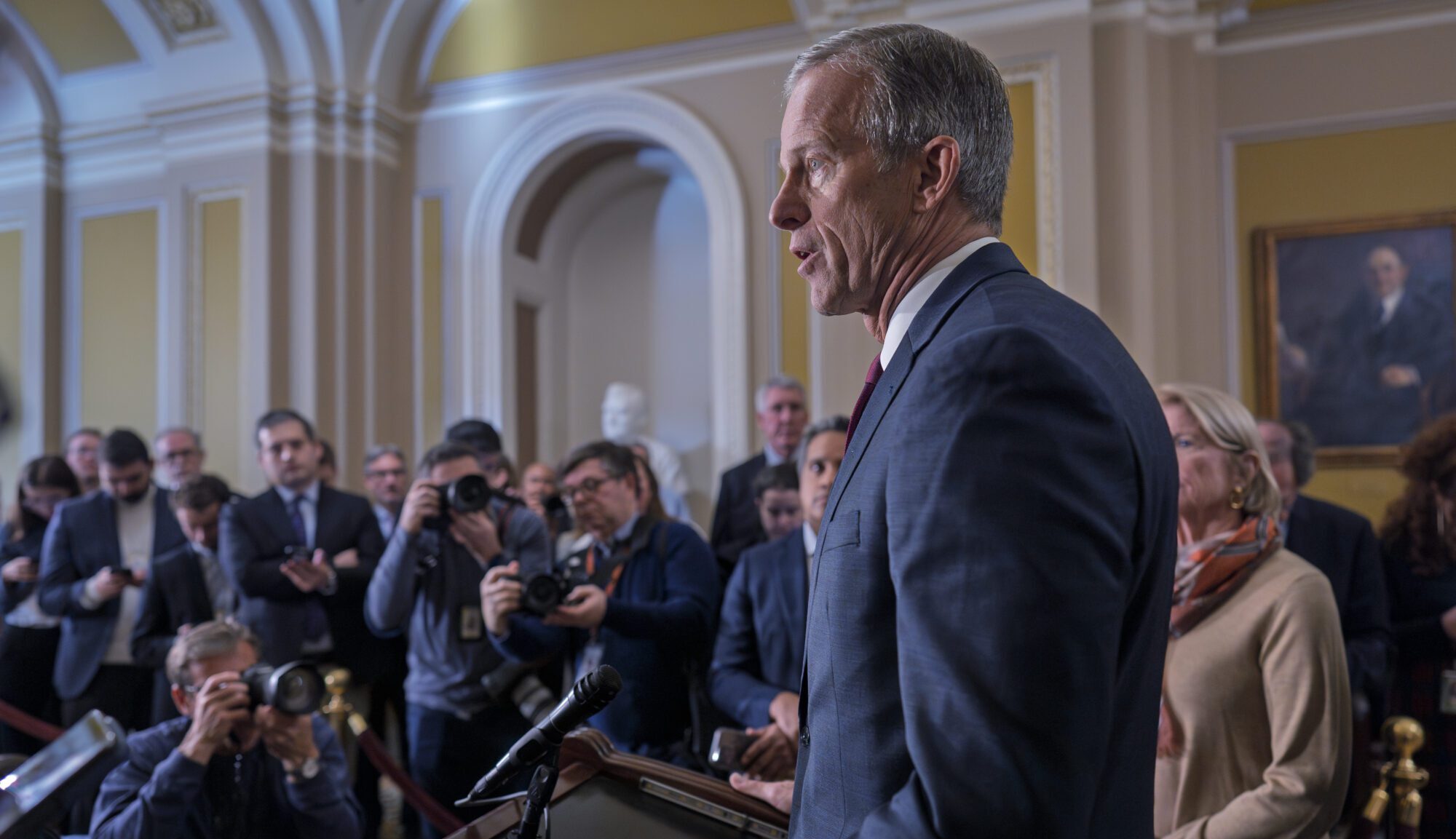

WASHINGTON, D.C. – U.S. Senator Thad Cochran (R-Miss.) today said his vote for the most significant federal tax reform in more than 30 years represents his optimism that the economy will grow as Mississippi families and small businesses keep more of their hard-earned income.

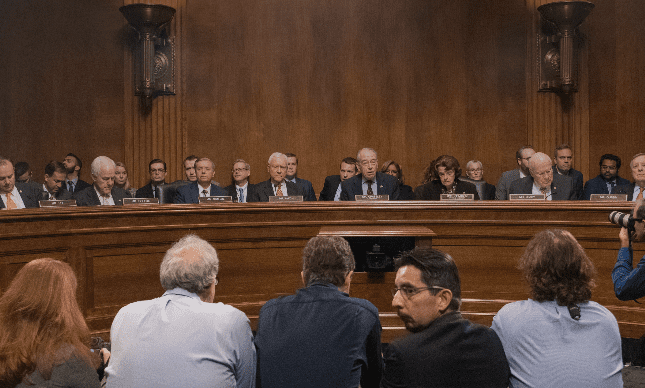

Cochran voted final Senate passage of Tax Cuts and Jobs Act of 2017, which passed on a 51-48 vote. President Trump has pledged to sign the bill into law. The measure will cut tax rates for individual taxpayers, overhaul small business taxes, and lower the corporate tax rate.

“This landmark legislation will help our economy grow. Importantly, this bill lowers personal tax rates, which will allow most individuals and families in Mississippi to keep more of what they earn,” Cochran said.

“I am optimistic that small businesses in Mississippi will take advantage of incentives in the bill that can help them grow. Corporate tax reforms will help companies be more competitive globally, invest more at home, and hire more American workers,” he said. “I look forward to the bill becoming law.”

The bill is a negotiated compromise between House and Senate-passed legislation. The final agreement nearly doubles the standard deduction for individual and joint tax filers. It expands the Child Tax Credit and preserves tax credits for child and dependent care, and adoption.

The bill eliminates the Obamacare individual mandate and associated penalties.

Enactment of this bill would permanently reform the tax code for small businesses and corporations. It includes a tax deduction to lower the marginal tax rate applied to pass-through business income for small businesses. For corporations, the bill lowers the tax rate to 21 percent and includes provisions to prompt American corporations to create more jobs at home.

The tax-writing committees in the House and Senate produced that attached document outlining policy highlights of the Tax Cuts and Jobs Act of 2017.

12/20/17