RELEASE

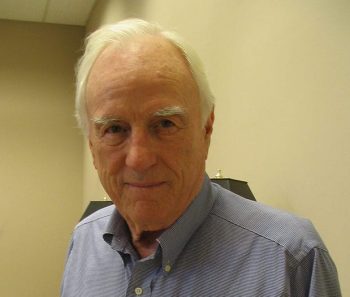

COCHRAN COSPONSORS “DEATH TAX” REPEAL LEGISLATION

Senator Renews Call for Permanent Repeal as New Administration & Congress Look at Broader Tax Reforms

WASHINGTON, D.C. — U.S. Senator Thad Cochran (R-Miss.) today said the long effort to repeal the federal estate tax or “death tax” permanently could get new life with a new administration and Congress in place.

Cochran is one of 24 original cosponsors of the Death Tax Repeal Act of 2017, which is intended to end a tax that is considered onerous to family businesses and farms. The legislation was introduced Tuesday by U.S. Senator John Thune (R-S.D.).

“The death tax amounts to a penalty on farmers and small business owners who face the prospect of their lives’ work being dissolved to satisfy the Internal Revenue Service,” Cochran said. “I am hopeful this idea will get a fresh look now that tax reform is being considered by the new Congress and the new administration in the White House.”

The Thune bill is supported by the American Farm Bureau Federation, Associated Builders and Contractors, National Association of Manufacturers, National Federation of Independent Business, Americans for Tax Reform, Club for Growth, National Black Chamber of Commerce, International Franchise Association, National Taxpayers Union, Family Business Coalition, the Family Business Estate Tax Coalition, and other groups.

Cochran has cosponsored similar repeal legislation in previous congresses. Last year, the repeal legislation was accepted as an amendment to the nonbinding FY2016 budget resolution passed by the Senate.

1/24/17