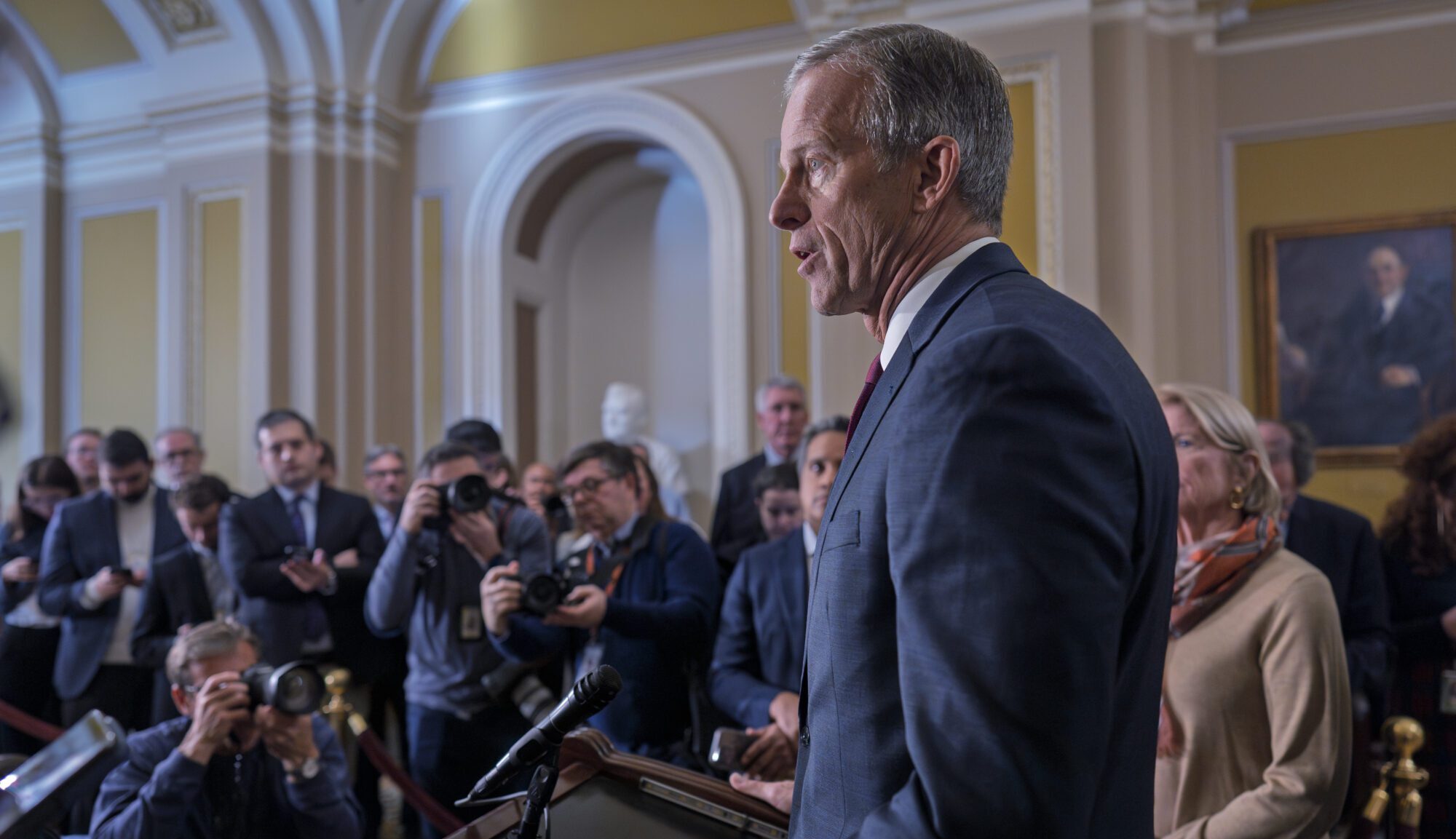

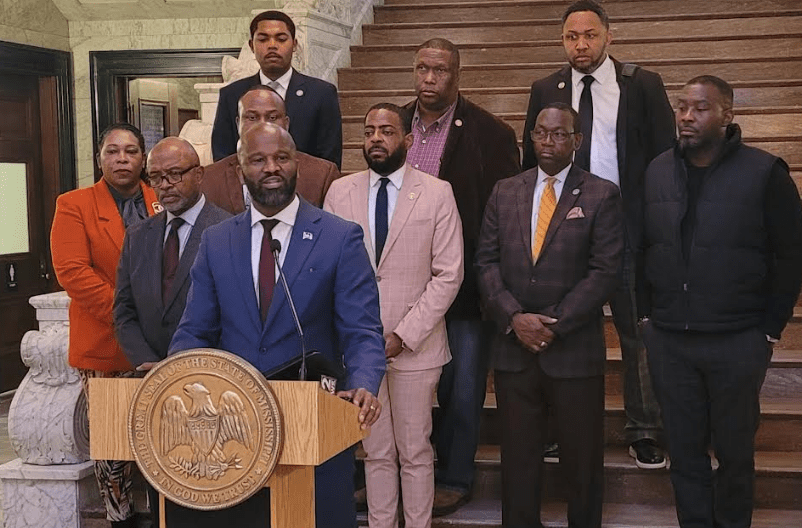

Speaker Gunn Statement on Teacher Pay Raise Bill Going to Conference

Jackson, MS—Today, House members voted to send House Bill 504 (HB504) to conference by a vote of 71-50. Three members from the House and three members from the Senate will work together over the next few weeks on compromise language.

“It is obvious that everyone in the Capitol supports a teacher pay raise,” said Speaker of the House Philip Gunn. “We in the House have passed a bill that would provide each teacher a raise. The Senate has followed our lead and done the same. We commend the Senate for coming around to our way of thinking regarding a pay raise. That being said, we are unable to concur on the bill they sent us last week.”

The reasons we do not agree with the Senate plan include:

1. The merit pay proposal is unconstitutional.*

2. The Senate Plan includes a smaller total amount than the House Plan: $2,500 vs. $4,250.

3. The Senate Plan supports lower starting salaries for teachers overall: $34,390 vs. $35,150.

4. The Senate’s merit plan disincentivizes good teachers to go to or remain in “C”, “D” and “F” schools. The money follows the school, not the teacher, under the merit-based Senate plan.

5. Therefore, under the Senate plan, 343 schools would not receive pay raises if we based the pay raise on today’s school ratings.

6. There is no guarantee that the merit dollars would go toward teacher salaries. That money could go toward supplies and equipment.

Statement regarding House’s conference position regarding teacher pay raise bill, House Bill 504:

“The House Republican Caucus position takes the pay raise of $2,500 in the first two years that the Senate has proposed,” said Speaker Gunn. “During the third and fourth years, we will get back up to the $4,250 total raise that the House originally passed. We will do that by placing a revenue trigger in the legislation that says if we hit three percent revenue growth in the third year, all teachers will receive $1,000. In the fourth year if we hit three percent revenue growth, all teachers will receive $750. We will remove the Senate’s unconstitutional language related to merit pay, and there will be no benchmarks for teachers to obtain a raise.”

*******

Constitutional Problems with Section 2 of Senate Amendment to House Bill No. 504

Senate Amendment

Section 2 of the Senate Amendment to House Bill No. 504 would create a performance incentive program for outstanding teachers and staff in highly productive schools, to be known as the School Recognition Program.

? The School Recognition Program would provide financial awards to public schools that earn school accountability ratings of “A” or “B” or improve at least one letter grade.

? The funds appropriated for the program would be distributed to the school districts, and the school recognition awards must be used for (a) nonrecurring salary supplements to the teachers and staff, and/or (b) nonrecurring expenditures for educational equipment or materials.

? The determination of how the funds are to be used would be determined jointly by the school’s teachers and staff.

Constitutional prohibition on payment of bonuses

? Section 96 of the Mississippi Constitution of 1890 provides that “The legislature shall never grant extra compensation, fee, or allowance, to any public officer, agent, servant, or contractor, after service rendered or contract made…”

? This is the provision that prohibits the awarding or granting of bonuses to public employees for work that they have already performed.

? Payments or expenditures of public funds when there is no pre-existing legal obligation to make the payment or expenditure, or in which payments are made for future services that have not been provided at the time the payments are made, are unlawful under Sections 96.

When constitutional prohibition not applicable

? While bonuses are prohibited by Section 96, there are a number of opinions of the Attorney General stating that incentive payments may be made to employees when (1) incentive provisions are agreed to by way of contract before performance; (2) there are predetermined objective standards of measurement, and (3) payments do not exceed a stated maximum amount set forth in the contract.

? The key distinction under Section 96 between permissible expenditures and impermissible expenditures rests on the presence or absence of a preexisting lawful contractual obligation. To avoid a violation of Section 96, an enforceable contractual obligation for an award must exist before an individual’s performance. In instances in which there is a lawful preexisting contractual obligation to make the payment, and the payment is made for services performed after the contractual obligation becomes effective, there is no violation of Section 96.

Constitutional analysis of payment of school recognition awards

? The performance incentive program for outstanding teachers and staff provided for in Section 2 of the Senate Amendment does not create a contractual obligation to make salary supplements to teachers and staff, because the specific use of the funds for the program would be determined in the joint discretion of the teachers and staff of the school.

? Unlike the salary supplements provided for teachers in Section 37-19-7(2), where a teacher knows that if he or she achieves a Master Teacher certificate, the teacher will receive an annual salary supplement of $6,000.00, the language of Section 2 does not ensure that any teacher would get a salary supplement; in fact, the language would allow for all of the funds to be expended for educational equipment.

? A teacher asserting a contractual right to a salary supplement on the basis of the language in Section 2 would likely not prevail because of the lack of specific language giving that right to the teacher for meeting predetermined objective standards of measurement.

? It is the discretionary nature of the payment of the salary supplement that causes the language in Section 2 to be in violation of Section 96. To avoid a violation of Section 96, an enforceable contractual obligation for an award must exist before an individual’s performance. That contractual obligation for the salary supplement is missing from the language of Section 2.