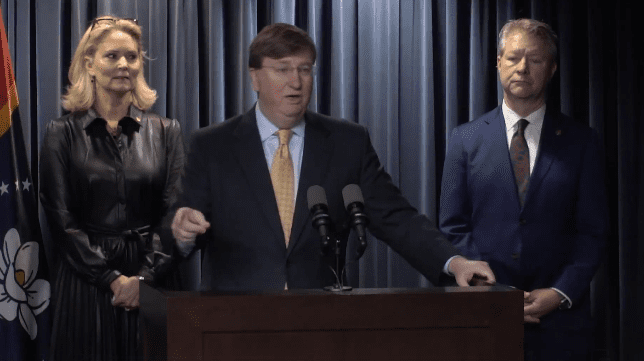

- Innovate Mississippi CEO Tony Jeff said gener8tor “brings the experience and resources needed to elevate Mississippi’s innovation landscape.”

Mississippi’s entrepreneurial ecosystem is starting the New Year with exciting momentum as efforts to secure new funding take shape.

gener8tor, a nationally recognized venture capital firm and accelerator network, is launching its first investment fund focused solely on Magnolia State startups. The firm is teaming up with Innovate Mississippi to connect local entrepreneurs with resources needed to grow and scale their businesses.

“Mississippi has immense potential,” said Emily Wykle, regional vice president of gener8tor. “We’re committed to playing a key role in its innovation landscape.”

Last November, gener8tor partnered with Innovate Mississippi as a sponsor of the 2024 Accelerate Conference and hosted an exclusive investor event that brought together Mississippi-based investors, higher education representatives, and civic leaders. Dinner conversation emanated from key issues contained in the white paper, “Towards a New System of Community Wealth” that addresses the significance of building a sustainable path to prosperity through innovation, investment, and community collaboration.

In the executive summary, the white paper states: “The U.S. is witnessing a radical shift—a quiet revolution—in its approach to the revitalization of distressed urban communities. For almost sixty years, the U.S. has dutifully delivered a top-down ‘Community Development’ system, narrowly focusing on producing low-income rental housing, with a mix of federal tax incentives, federally encouraged bank debt, and direct federal subsidies. Over the past decade, a new system has begun to emerge, focused on developing people rather than buildings, with a blend of public, private, civic and community leadership and capital. This system, which we label ‘Community Wealth,’ is being raised bottom up, and is fundamentally committed to upgrading skills, growing entrepreneurs, increasing incomes, and building assets.”

The summary concluded; “At the same time, a new class of investors is entering the community space, focused on growing entrepreneurs and building strong local economies. Both the evolution of the old system and invention of the new have been accelerated by the latest federal tool, Opportunity Zones.”

gener8tor, established in 2012 in Wisconsin, intentionally invests in communities outside traditional U.S. venture capital hubs, like New York, California, and Massachusetts, noted Wykle.

“More than 80 percent of venture capital dollars go to those three states,” said Wykle. “Our company has focused on investing in the rest of the places that have many good ideas, but not much capital. We’ve been active in the South for a long time in markets like Alabama, Georgia, and Tennessee. Mississippi has strong angel activity. We’re excited to have a presence now in Mississippi.”

In Alabama, since 2020, gener8tor’s portfolio companies have raised nearly $80 million in capital and created more than 1,000 jobs.

“We aim to unlock Mississippi’s potential in a similar way,” she said.

Innovate Mississippi CEO Tony Jeff said gener8tor “brings the experience and resources needed to elevate Mississippi’s innovation landscape.”

Here’s how it works: Innovate Mississippi funnels Department of Treasury funds, earmarked to spur growth of startups and high-growth technology companies in the state, through SSBCI (state small business credit initiative) dollars that require one-to-one private sector matching funds. gener8tor is one of the approved funds for up to $5 million in matching funds.

“For example, if we raise a million dollars from the private sector, we get a million dollars from Innovate Mississippi,” she explained. “It’s a very smart plan that keeps wealth local.”

gener8tor initially focused on the Midwest.

“We initially managed our venture capital fund like a federal model, with one central venture capital fund investing in accelerator cohorts across the country,” said Wykle. “When we moved outside the Midwest, it no longer made sense to operate this sort of centralized federal fund. It made sense to have a small group of investors who are really excited about investing in companies locally, with the returns staying local rather than leaving the state.”

gener8tor now operates accelerators in 46 cities via a grassroots approach. “We spend a lot of time on the ground working alongside communities,” she said, pointing to universities as stellar breeding groups for identifying the best startups.

For the first half of 2025, gener8tor is focused on raising private sector matching dollars. The next steps: a first close on the fund, from both public and private sector investors, resulting in a fund to deploy.

“The second half of the year, we should start writing checks,” Wykle explained.