- Columnist Bill Crawford writes that it seems like something’s gotta give with major reductions in federal spending posing a double whammy for state revenues.

Mississippi is highly dependent upon federal dollars, both for its operating budget and for taxable spending by individuals and businesses. The incoming Trump administration and the new Republican majorities in Congress are preparing to whack those dollars.

The whacks include decimation of the federal workforce and reductions in farm subsidies.

President-elect Trump and his new sidekick Elon Musk have promised to “dismantle government bureaucracy” through big, immediate cuts in the federal workforce.

The Heritage Foundation’s Project 2025, favored by many in the Trump camp, calls for eliminating a number of farm bill programs including the popular Conservation Reserve Program. The Mississippi Farm Bureau has been in Washington warning that without an expanded farm bill plus disaster relief, “we fear widespread bankruptcies and an overall economic disaster in the Mississippi farming community, which would have devastating effects on many of our rural communities across the state.”

Surely, Mississippi leaders will pause future tax cuts until the impact of these and other federal cuts on state revenues can be assessed.

Uh, no.

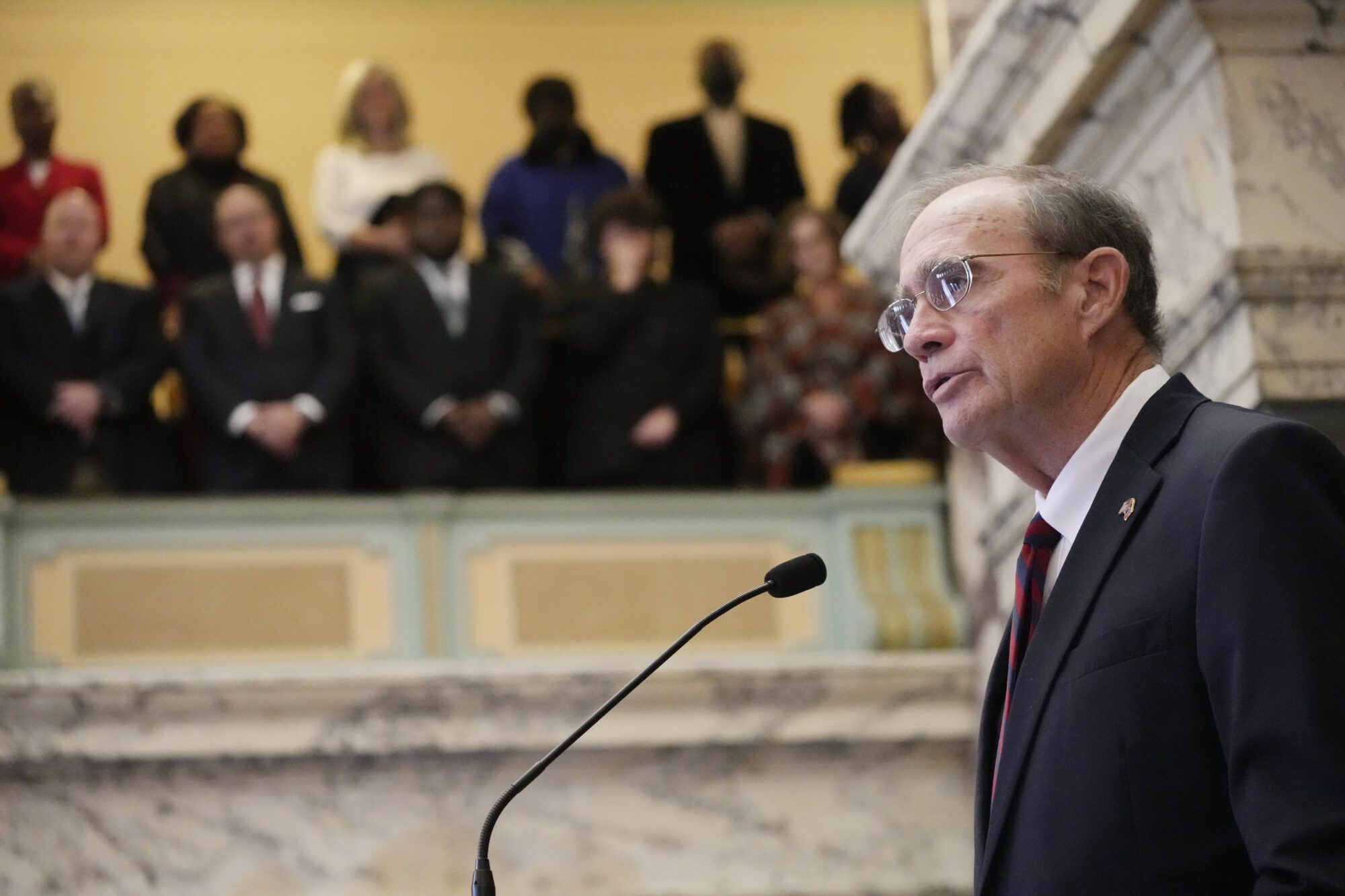

Gov. Tate Reeves told the Associated Press he will continue pushing elimination of personal income taxes. Lt. Gov. Delbert Hosemann and Speaker of the House Jason White still want to cut taxes.

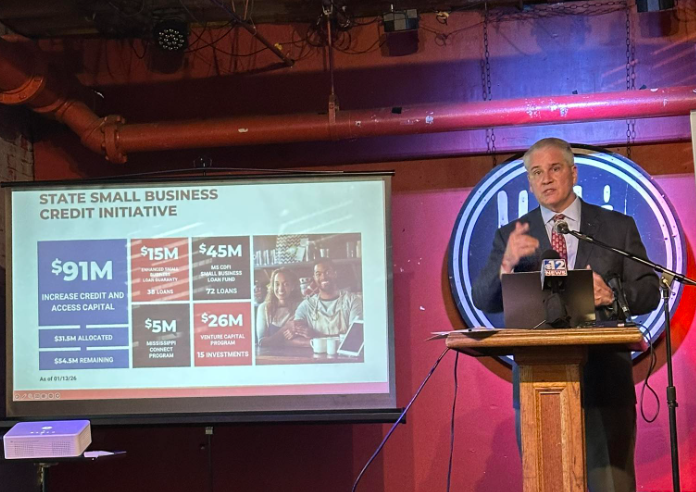

And the Joint Legislative Budget Committee just adopted a preliminary state revenue estimate for fiscal year 2026 that plans for a $26.9 million increase to $7.627 billion.

Hmmm. Seems like something’s gotta give with major reductions in federal spending posing a double whammy for state revenues.

Whammy 1: Mississippi ranks as the fourth most dependent state on federal funds with more than 40% of its overall budget coming from federal sources. That amounted this year to $13.2 billion spread across 38 state agencies.

Major cuts will put pressure on state funds to make up shortfalls and/or result in staff reductions. Program cuts and staff reductions will impact taxable spending by businesses and individuals dependent upon those expenditures.

Whammy 2: Another $22 billion comes into the state outside of the state budget from federal payments and subsidies. This also generates significant taxable income and spending for thousands of residents.

There are over 27,000 federal employees in Mississippi with annual wages totaling over $2.3 billion. Thousands more employees have incomes dependent upon $4 billion in defense contracts, $1.9 billion in agriculture payments and subsidies, and billions more in other grants, contracts, and subsidies.

There are thousands more who depend upon $13.9 billion in Social Security payments and $1.9 billion in payments to veterans.

Then, there are those of us who depend on our state leaders to make prudent fiscal decisions.

“The prudent give thought to their steps” – Proverbs 14:15.